15% drop in Detroit: Opportunity or threat?

Vous pouvez retrouver le version française de cet article en cliquant ici.

For some time now, it has been possible to find articles or tweets indicating that real estate has dropped in the Rust Belt area, where RealT has established a strong presence. Some rumors even posit a drop of up to 30% in the next few months. We thought it would be interesting to share with you our analysis of this situation.

Here’s a link to an article on this subject: https://www.realtor.com/news/trends/where-home-prices-falling-the-most/

It is true that today and in the coming months, certain types of real estate will be impacted for the following 3 reasons:

- Rising interest rates

- Increasing property taxes

- Location and type of property

Let’s examine each of these.

State of the market

1 – Rising interest rates

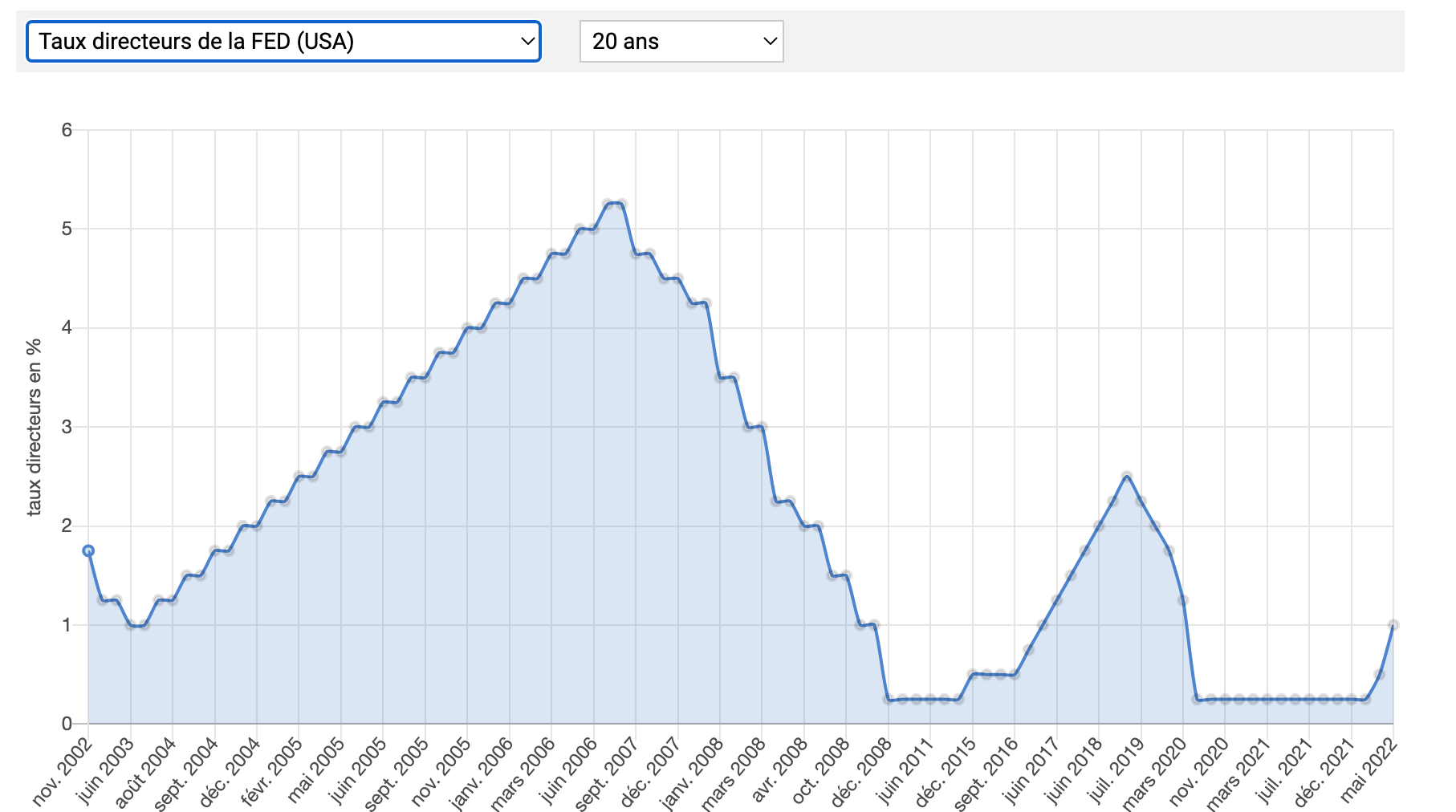

In the United States the policy rate has risen by 0.75% since the beginning of 2022 and the bond rate has reached 2.80%. This rate had not been reached for 11 years. According to the latest statements, they could continue to rise in the coming months with a potential increase of 2%.

FED 20-year policy rate

US 10-year bond rate

What are the consequences of this rise in rates?

Since the subprime crisis, access to fixed rates has become widespread for many households. A part of the population still only has access to variable rates. Moreover, in the United States, it is very common to borrow to buy a house, a car, to finance your children’s education, to go on vacation or to pay for shopping.

Households that had never bought their homes began to do so during COVID. Americans were able to pull two levers:

- Interest rates were close to 0%. With these low rates, many families had calculated that borrowing and buying their homes would be cheaper than renting. For example, during this period, borrowing would cost them about $850 per month while renting would have cost them $1,000.

- The government distributed a Paycheck Protection Program (checks to households were given as well as free loans). These measures provided the initial deposit to borrow and buy their homes.

Now these households are faced with rising interest rates and increasing property taxes. Their monthly payment, which was $850 is now about $1,200. We are going from a situation where these households are saving money to a situation where they have to pay more. Furthermore, as previously stated, Americans are expecting rates to rise again. Their monthly payment should therefore continue to increase.

As indicated in this article, in only one year, fixed rates have increased by more than 55%, from about 3% to 5%.

2 – Increased property taxes

Since the COVID crisis (2020-2021), the real estate market has appreciated sharply. Because of the sanitary measures, the property revaluation agencies could not move and they fell behind. For several months, these independent experts have been catching up.

As a result of these revaluations, property taxes are increasing. Most individuals who have acquired their main house for the first time do not know all the tricks to lower or contest the increase of these taxes. Professionals and institutions hire companies that specialize in optimizing these property taxes. They take a percentage of the savings made. Thanks to its economy of scale, RealT can negotiate the percentage taken by these companies.

3 – Location and type of property

The consequence of these two factors is that some households will prefer to become tenants again rather than remain owners. These households are not dumping their properties, but selling them at the price they acquired 2-3 years ago. Furthermore, it is impossible to generalize this 18% drop mentioned in this Realtor article to the entire city of Detroit. We need to add granularity to this analysis by segmenting the market.

For starters, the high-end market is not experiencing a decline. These individuals have negotiated fixed rates with their banks. They have the resources to hire companies to renegotiate their property taxes.

The affected assets are B and B+ assets. These types of assets are primarily homes between $500,000 and $ 2,000,000. These households prefer to remain renters because, as indicated in this article, the monthly payment goes from $1,124 to $1,742 for a $357,000 house. We will let you imagine the difference in monthly payments for a $600,000, $1,000,000 or $1,500,000 property.

To learn more about the classification of property we encourage you to read this article.

In RealT’s portfolio, Bird could have fit into this category. However, this property is in a specific micro -market: Birmingham. Even during the 2008 crisis, this neighborhood did not significantly decline.

This property could have been impacted if it had the following 3 prerequisites:

- Located in a different neighborhood such as 20 minutes from Atlanta

- 80% mortgaged

- Owned by a family

However, as a reminder, Bird:

- Is located in a micro-market

- Is not mortgaged, since it was 100% funded by its token holders

- RealT has signed a long-term contract with a company to house its executives in Bird.

Finally, the low-income market will remain stable or will probably continue to grow. The number of tenants will continue to increase in the coming months. The number of real estate transactions will decrease in number but not necessarily in value. The players in this market will change from a predominantly retail market to an institutional market.

Opportunity or threat for RealT?

If you’ve read Episode 1 and Episode 2 of this series, you understand the strategy and processes RealT uses. However, it seems that not everyone feels the same way, and has some legitimate questions:

Translation of this tweet: “After the fall of cryptos and NFTs, the fall of a stablecoin, I will see the fall of tokens in real estate. We’re selling 10%+ yields on US real estate while it’s in the bubble… There’s going to be blood on the walls again.”

1 – The fundamentals

We advise you to read our first 2 episodes for more details, but in a few lines, RealT offers accommodation for low income households. These types of properties are called in our jargon “bread and butter” properties, or community properties. As Remy says, RealT does not buy these properties on an emotional decision like an individual who already sees themselves living in them. These properties are negotiated to be purchased at an excellent purchase price, due diligence has ensured that the property’s foundation is in good condition and the tenants are healthy and creditworthy. These properties offer stable rents month after month. RealT focuses on offering high-yield properties and does not make emotional decisions — otherwise you would find properties on the marketplace with 2% yield. When Remy says that he finds a property beautiful, he finds it beautiful from the point of view of an investor who wants to build a balanced and diversified real estate portfolio.

RealT’s properties are 100% funded by the token -holders. Indeed, if the properties offered by RealT were mortgaged at 80% and the interest rates exploded, then it would be difficult to keep these rates of return. Today, thanks to the RMM, it is possible to put these RealTokens up as as collateral. If you want to know more you can read this article.

2 – Is the US real estate market in the middle of a bubble?

In the first part, we saw that it was necessary to have a degree of granularity in our analysis and that it was true that some segments were overheating. On the other hand, if we are in a real estate bubble, then we are saying that real estate prices are too high.

In this article, we have seen how the RONA is calculated. As a reminder, the expected return is equal to the net income / price of the real estate. The more the real estate price increases, the more the expected income decreases. Today the average net expected income on the 200 properties tokenized by RealT is close to 10.3% net.

We can understand that some people want to remain very cautious and that they consider that there are certain risks.

What are these risks?

Falling real estate prices?

If the price of real estate goes down, it means that the expected yield goes up. In the secondary market, investors might be interested in buying these properties with this kind of yield. It is very likely that demand will outstrip supply, which would bring the RealToken probably close to today’s value.

On the other hand, we can take as an example our property 272 NE 42nd Court located in Florida. Purchased in June 2020 for $155,000, it was revalued in early 2022 at a price of $325,000. Its price doubled and subsequently the expected income went from 7% to 3.74%. RealT has for the moment stopped in this area because this area has risen sharply in recent months. Tokenholders can take advantage of this increase to borrow more on the RMM and diversify their portfolio to keep a good health factor. Tokenholders can resell them on the secondary market with Swapcat or to RealT for a 3% fee. As you may have noticed, when RealT puts them back on sale during a wild sale, these realTokens are sold in less than an hour.

Tenants who don’t pay their rents?

As a reminder, RealT started in a niche which is the Section 8 program. During the COVID crisis, many tenants stopped paying their rents and despite more flexible rules than in Europe to evict tenants, RealT has not been impacted by non-payment. With the Section 8 program, the government pays RealT and the Tokenholders directly.

Today, the latest properties offered by RealT have no Section 8 tenants, and thanks to its growing portfolio in Detroit, RealT has been able to build up a waiting list of serious tenants waiting for housing. In addition, there is a cap on the increase in Section 8 rents. There is a significant difference between a section 8 rent and a non-subsidized rent which is indexed to the real market.

In the end, where does the return come from?

Through its expertise, RealT buys high-potential real estate at a great price in areas where not everyone wants to go. RealT believes that Detroit is rising from the ashes. The Jacobson brothers are using the same strategy as in Montreal or Miami. With their economy of scale strategy, they are saving money on renovations and management. Just look at the budgeted cost of the roof renovation for 19000 Fenton St, Detroit, MI 48219.

3 – Plan for the future

As Jean Marc says, “So most of the people who were renting in A-, B+ buildings will start coming to our ‘C’ buildings. And those in our C buildings will move further out of town. We’ve experienced this many times.”

To learn more, about property classification we encourage you to read this article.

If the market starts to slow down, this would be a boon for RealT. As a reminder, in the beginning RealT managed to find and close deals where the expected RONA was between 12% and 14%. Today, it is between 9% and 11%. In the beginning, RealT could easily negotiate up to 6 months of delay to close the deal. Today, it is a victory when RealT manages to negotiate for 2 months.

Finally, this overheating would allow RealT to buy strategic assets in its economy of scale and concentric circle strategy. By purchasing properties that are too expensive or not currently for sale, RealT could continue to beautify certain neighborhoods and streets where RealT already owns some properties. In these areas, every dollar invested benefits other properties in the surrounding area, increasing the value of the overall portfolio.

From an investor’s point of view, tokenization allows you to diversify your real estate portfolio with an entry ticket of $50 and an expected income of 10%. The most skeptical predict a rise in unemployment and tenant insolvency resulting in at least 20% of unpaid rent. In such a scenario, the net return would be close to 8% with a diversified portfolio. Moreover, thanks to decentralized finance, you will soon be able to subscribe in 2 clicks to a decentralized insurance against these unpaid rents thanks to our partner Opium Network.

Disclosure

This information is not an offer to invest in any token or other opportunity and is provided for information only. Any offer to sell or solicitation to buy interests in the Issuance will be made only by means of an offering memorandum delivered by an employee or agent of the Issuer. Any references to past performances are informational and cannot be considered to indicate or guarantee any future results. Investing in crypto currencies involves a substantial degree of risk. There can be no assurance that the investment objectives described herein will be achieved. Investment losses may occur, and investors could lose some or all of their investment. Performance results are shown net of all fees, costs, and expenses associated with the token. Should an investor choose to redeem a token through RealT or on a secondary market, other processing fees may be assessed that are not factored into the returns presented.