Fractional and frictionless real estate investing

Ownership Reinvented

For the first time, investors around the globe can buy into the US real estate market through fully-compliant, fractional, tokenized ownership. Powered by blockchain.

DeFi Integrated

Discover the Power of the RealT RMM Platform

Leverage your assets like never before with the power of Decentralized Finance on the blockchain.

The RealT RMM collateralization platform lets you supercharge your tokenized real estate portfolio.

It looks like you’re in the U.S.

Thank you for your interest in RealT. We’re currently working on a new offering for U.S. persons that is not yet ready for distribution. It’s coming soon – register and we’ll be sure to notify you when it’s ready!

We appreciate your understanding as we continue to redefine real estate investing around the globe.

Year-Over-Year Asset Performance

Based on most recent property revaluations

+23.49%

15240 Edmore Dr

+23.66%

14622 Hubbell Ave

+23.19%

8056 E Hollywood St

+22.89%

19535 Fairport St

+22.63%

(S) 22233 Lyndon St

+25.60%

(S) 11310 Abington Ave

+22.65%

(S) 9624 Abington Ave

+21.47%

(S) 11217 Beaconsfield St

+22.78%

(D) 11117 Worden St

+23.36%

(S) 11117 Worden St

+22.07%

(S) 10703 McKinney St

+22.56%

(S) 14117 Manning St

+22.97%

(S) 9585 Abington Ave

+23.81%

(S) 14439 Longview St

+24.62%

(D) 17204 Bradford Ave

+24.62%

(S) 17204 Bradford Ave

+23.65%

(S) 19391 Grandview St

+22.57%

(S) 9200 Harvard Rd

+24.04%

(D) 10645 Stratman St

+24.04%

(S) 10645 Stratman St

+22.35%

(D) 11965 Lakepointe St

+22.89%

(S) 11965 Lakepointe St

+22.79%

(D) 10163 Duprey St

+23.46%

(S) 10163 Duprey St

+19.35%

11898 Laing St

+19.51%

20257 Monica St

+21.52%

16520 Ilene St

+21.42%

(D) 10147 Somerset Ave

+21.42%

(S) 10147 Somerset Ave

+20.18%

324 Piper Blvd

+20.63%

(D) 9795-9797 Chenlot St

+20.63%

(S) 9795-9797 Chenlot St

+20.65%

3310-3312 Sturtevant St

+22.00%

7519-7521 Wykes St

+21.30%

9415-9417 Ravenswood St

+21.98%

2703-2705 W Grand St

+22.02%

4342-4344 Cortland St

+17.65%

1389 Bird Ave

+21.68%

19268 Eureka St

+20.79%

3323 Waverly St

+19.75%

9135 Yorkshire Rd

+20.42%

4000 Taylor St

+20.35%

12730 Wade St

+20.84%

5517-5519 Elmhurst St

+25.67%

2661-2663 Cortland St

+22.05%

5846 Crane St

+22.49%

12779 Strathmoor St

+20.53%

18668 St Louis St

+21.43%

19144 Riopelle St

+7.86%

20039 Bloom St

+20.67%

19962 Waltham St

+25.73%

2950-2952 Monterey St

+21.02%

20552 Waltham St

+18.91%

8531 Intervale St

+21.69%

17616 Beland St

+23.15%

14263 Ohio St

+19.82%

18949 Fenmore St

+19.77%

20418 Andover St

+20.73%

14432 Wilshire Dr

+17.23%

19154 Sherwood St

+20.28%

882-884 Pingree St

+19.48%

15208 Bringard Dr

+19.77%

116 Monterey St

+20.94%

14215 Hampshire St

+29.78%

15841 Coram St

+20.90%

11758 Christy St

+22.68%

14839 Wisconsin St

+21.69%

14884 Ward Ave

+23.55%

15379 Patton St

+20.50%

12410 Hamburg St

+21.66%

15864 Eastburn St

+19.79%

7109-7111 Pilgrim St

+18.61%

7430 Nett St

+6.55%

5772-5774 Chalmers St

+22.79%

5278-5280 Drexel St

+25.72%

19191 Bradford Ave

+18.63%

10003 Pinehurst St

+23.41%

893-895 W Philadelphia St

+19.50%

10021 Grayton St

+19.28%

15203 Park Grove St

+22.39%

13370 Wilshire Dr

+22.50%

11957 Olga St

+23.90%

12409 Whitehill St

+24.81%

13606 Winthrop St

+23.88%

19996 Joann Ave

+20.33%

17500 Evergreen Rd

+16.03%

15753 Hartwell St

+20.67%

11653 Nottingham Rd

+23.55%

19200 Strasburg St

+13.30%

18983 Alcoy Ave

+23.27%

14494 Chelsea Ave

+22.89%

13045 Wade St

+24.87%

10639 Stratman St

+24.76%

9920 Bishop St

+23.61%

9481 Wayburn St

+20.11%

10629 McKinney St

+22.49%

11300 Roxbury St

+22.32%

14229 Wilshire Dr

+22.44%

18776 Sunderland Rd

+24.20%

17809 Charest St

+9.79%

14882 Troester St

+22.57%

14825 Wilfred St

+23.97%

11078 Wayburn St

+18.51%

15860 Hartwell St

+24.64%

11201 College St

+24.15%

19333 Moenart St

+24.21%

8181 Bliss St

+24.36%

12866 Lauder St

+25.44%

15350 Greydale St

+26.76%

15373 Parkside St

+26.71%

14231 Strathmoor St

+20.65%

19218 Houghton St

+22.91%

9465 Beaconsfield St

+27.85%

19136 Tracey St

+24.80%

19020 Rosemont Ave

+18.07%

18273 Monte Vista St

+23.03%

15095 Hartwell St

+24.76%

18466 Fielding St

+28.84%

15770 Prest St

+21.64%

19596 Goulburn Ave

+29.19%

18481 Westphalia St

+28.19%

15039 Ward Ave

+25.08%

19311 Keystone St

+25.19%

4680 Buckingham Ave

+39.77%

4061 Grand St

+29.40%

19163 Mitchell St

+25.67%

19201 Westphalia St

+25.79%

9717 Everts St

+25.55%

15796 Hartwell St

+24.08%

17813 Bradford St

+24.70%

4380 Beaconsfield St

+26.84%

13895 Saratoga St

+27.36%

14078 Carlisle St

+26.74%

14319 Rosemary St

+28.46%

15777 Ardmore St

+25.64%

19317 Gable St

+26.16%

13116 Kilbourne Ave

+27.28%

13114 Glenfield Ave

+31.91%

15784 Monte Vista St

+25.71%

15778 Manor St

--5.80%

581-587 Jefferson Ave

+23.16%

10604 Somerset Ave

+26.73%

9133 Devonshire Rd

+24.94%

6923 Greenview Ave

+21.52%

13991 Warwick St

+35.17%

18433 Faust Ave

+19.79%

10974 Worden St

+20.89%

12334 Lansdowne St

+27.54%

3432 Harding St

+29.44%

9169 Boleyn St

+21.38%

10616 McKinney St

+30.11%

9309 Courville St

+24.70%

10612 Somerset Ave

+28.83%

9166 Devonshire Rd

+21.92%

10084 Grayton St

+28.30%

9165 Kensington Ave

+61.36%

272 N.E. 42nd Court

+25.63%

15048 Freeland St

+28.38%

15634 Liberal St

+29.37%

18900 Mansfield St

+25.35%

18276 Appoline St

+32.72%

25097 Andover Dr

+23.95%

8342 Schaefer Hwy

+23.24%

10024-10028 Appoline St

+21.10%

16200 Fullerton Ave

+21.71%

9943 Marlowe St

+22.85%

5942 Audubon Rd

+22.29%

20200 Lesure St

+19.77%

9336 Patton St

Real estate is still the best investment you can make.

But you don’t have to take our word for it.

According to these nine Advisors in The Oracles, who made millions by investing in real estate, it’s still the best way to build wealth. Read more at CNBC.com >

Permissionless, compliant, and first-of-its-kind

RealToken provides investors with a simple, intelligent, and user-friendly method to buy into fractional, tokenized properties, leveraging the U.S. legal system and the permissionless, unrestricted token issuance of Ethereum.

Investing with RealT means low maintenance property ownership, access to cash flows related to the property (e.g., rent), and frictionless ownership transactions via RealTokens.

Grow a global, digital real estate portfolio

Unique Tokens

Ownership of each property is distributed across a finite number of representative tokens. Based on token share, owners can collect revenue from rent, and vote on property decisions.

Property Managed

Each RealT property has a property management company managing the property on RealToken owners behalf. The property management company sources tenants, collects rent, and manages repairs, so the diverse group of RealToken owners don’t have to.

INC/LLC Owned

Real estate can’t directly be tokenized, but legal entities can. Each property is owned by company (either an Inc or an LLC). Each company is tokenized as a unique set of RealTokens and made available for purchase.

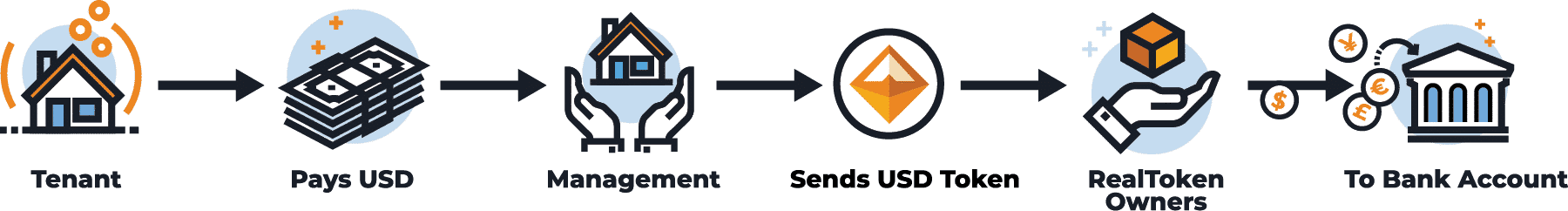

Weekly Rent Payments

With blockchains, we no longer need to wait 30 days to receive a bank transfer. Owning property with RealT allows you to collect rent every week. Rent is paid using a US-Dollar stablecoin, sent to your Gnosis Chain or Ethereum wallet.

Rent payments are automatically sent to investors

Tokenizing Real Estate

The future of real estate investing is fractional

Tokenizing real estate has become the focus of many institutions in 2018, and is likely to continue into the future as Ethereum offers a way to add improved levels of liquidity (tokens) to a notoriously illiquid industry (real estate).

Fractional ownership democratizes access to real estate investment, and therefore distributes and minimizes the risks and labor involved with owning property. And RealToken makes it even simpler!

Learn more about RealT

Un nuevo actor se une a la revolución de la tokenización de activos inmobiliarios

RealT, líder de la tokenización inmobiliaria, WiSEED, pionero del crowdfunding en Francia, y Twenty First Capital, actor principal de la gestión de fondos inmobiliarios, han anunciado la creación de un consorcio con la ambición de convertirse en el líder del sector de...

Naissance d’un acteur de premier plan de la tokenisation d’actifs immobiliers en Europe

RealT, leader de la tokenisation immobilière, WiSEED, pionnier du crowdfunding en France, et Twenty First Capital, acteur majeur de la gestion de fonds immobiliers, annoncent la création d’un consortium avec l’ambition de devenir le leader du secteur de la...

Birth of a Leading Player in Real Estate Asset Tokenization in Europe

RealT, the leader in real estate tokenization, WiSEED, the pioneer of crowdfunding in France, and Twenty First Capital, a major player in real estate fund management, announced the creation of a consortium with the ambition to become the leader in the real estate...

Construir sua Renda Passiva com Imóveis na Blockchain

Construir sua Renda Passiva com Imóveis na Blockchain O Mercado Imobiliário, que sempre foi um setor conhecido por ser relutante a inovações, segue em constante evolução tecnológica! Tokenização é a criação de ativos digitais que representam outros ativos, sejam...

Episode 7: On the road to Web3 mass adoption, RealT continues to innovate!

The power of the Blockchain with the simplicity of the traditional web made possible thanks to “walletless” Vous pouvez retrouver le version française de cet article en cliquant ici. In this news release, RealT announced the launch of "Walletless", a feature that...

Épisode 7 : En route vers l’adoption de masse web 3, RealT continue d’innover !

La puissance de la Blockchain avec la simplicité du web traditionnel rendue possible grâce au “walletless” You can find this article in English by clicking here. Pour rester leader sur le marché de la tokenisation immobilière, RealT continue d’innover dans l’univers...