One of the best features of RealT is the ability to access passive income on your real estate investments. RealT pays rental income to investors in RealT properties on a regular basis. On the July 2 RealT Community Call, we announced that a new Rent Disbursal mechanism is finished and ready for deployment. Over the next 30 days, we would phase-out our old system for this new one. This post is about generating clarity around this new system, and highlighting its strengths and weaknesses, so we can gather feedback from the community!

You can watch the call here:

https://www.youtube.com/watch?v=6qE1z0o36qs

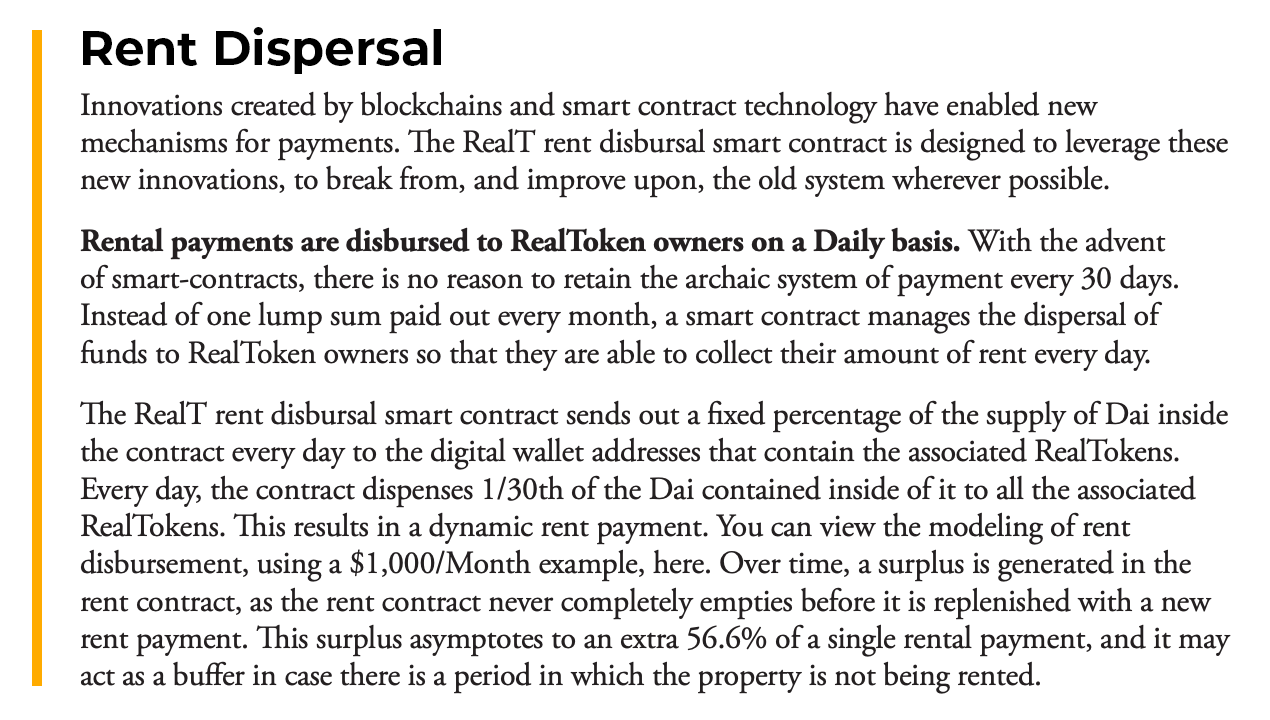

Stepping back to the very beginning of RealT, the mechanism being described here is largely the original mechanism discussed in the RealT whitepaper:

Ethereum and the DeFi ecosystem is perpetually growing; things change! The following things have been updated from this original specification:

RealT disperses rent in USDC instead of DAI

While we love DAI, DAI’s are not Dollars, and USDC’s are. When tenants pay their rent to their property manager, they pay in Dollars, not DAI’s. The rental payments can be converted 1:1 for USDC, whereas DAI must be purchased on the secondary market.

RealT disperses rent every 3 days instead of every day

At the time of writing of the RealT whitepaper, gas prices on Ethereum were 1-gwei or less. It cost almost nothing to send rent out to property owners. Ethereum has grown significantly since then, and blockspace is in much higher demand. As a result of this, RealT disperses rent every 3 days, which reduces gas costs by 2/3rds. This new rent dispersal mechanism will reduce gas costs significantly, but we will have to wait and see if it reduces it sufficiently to resume daily rental payments. We are excitedly watching the Rollups and L2 development progress on Ethereum, and keeping an eye out for a system that fits our needs! Daily rental disbursements is the goal, and it is likely that Ethereum is currently in this intermediary phase where scaling tech is still in the process of rolling out, while DeFi is already maturing rapidly! As a result, many people are making L1 transactions and pushing up the costs of transacting. As scaling technology follows suit in maturity, we are optimistic that we will discover a way to make daily L1 rental payment transactions. Importantly, this new rental payment mechanism is an important first step in bundling all of RealT’s rental payments into a more efficient package.

RealT properties distribute rent in single lump payment

This is a core component of the new rental system being described. Instead of receiving one payment per property, RealT property owners will receive one lump payment that is a collection of all their owned properties, at once. More on this later (and also in the community call video)

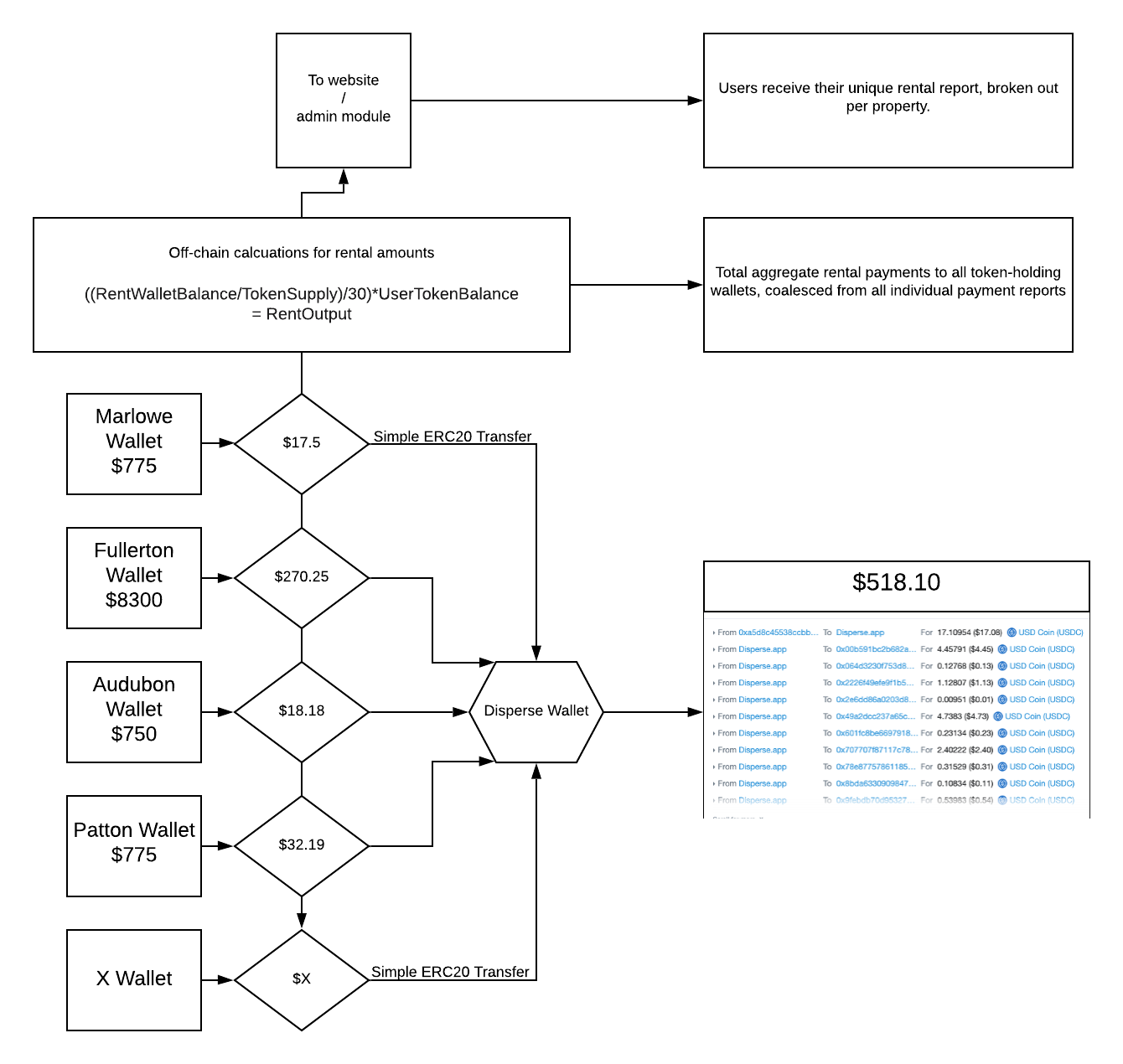

Here is a diagram (with mock values) of the discussed rental payment system:

Step 1. Each property receives their own deposits of USDC, which comes from the rental payments made by the tenant of the respective property. This is shown in the squares on the left. The ‘Property Wallet’ is the same wallet that the tokens of that wallet are initially distributed from.

Step 2. An off-chain process takes the account-balances of every RealToken-holding wallet, and calculates how much USDC is to be paid to each wallet, on a per property basis.

Off-chain math:

((RentBalance / TokenSupply)/30)*TokenBalance

= RentOutput

This method of calculating rent takes 1/30th of the balance inside the Rent Wallet for a specific property, and distributes it pro rata to all token holding individuals, for that specific property. Each property generates a RentOutput value for the given time period.

Step 3. All Property Wallets make a USDC transfer of the calculated RentOutput value from Step 2, to a single central wallet, the Disperse Wallet, where the funds are prepped for final dispersal.

Step 4. The collective RentOutput amounts from all individual properties coalesce into a single bulk-transfer of USDC to all RealToken-owning wallets. Regardless of whether you own just one RealT property or all of them, users receive all of their rent with one single payout transfer.

Step 5. Users are able to see the breakdown of their payout on a per-property basis on the RealT website in their user account. Inside the Portfolio section of the user account, RealT property owners will be able to see which properties paid how much rent for any given payout period. These values will be summarized on a monthly basis, but will also be able to be broken out into individual payouts for those who enjoy working with data. This is also how users will be able to generate rental income reports for their personal finance needs.

Getting into the Nuances

The above mechanism has a number of strengths, and some weaknesses as well. Lets dive into them!

Flexibility

Currently, RealToken holders have been receiving artificially stable rental payments. The same amount of rent is paid on a regular basis. If a RealT property tenant is late to pay rent, it currently does not impact the token holders. This is because RealT has been absorbing the risk of this irregularity by paying out token holders regardless, and simply collecting the rent at a later time. So far, RealT tenants have been dependable and responsible tenants. however if RealT is to scale to hundreds and thousands of properties, it cannot act as a middleman-buffer between the rent being collected, and the rent being dispersed to token holders.

The 1/30 calculation allows for rent to be deposited into the RentWallet whenever it is collected. Regardless of whether rent is collected on the 1st, 5th, 15th, late, early or whenever, it doesn’t matter. Whatever and whenever rent is collected, it is sent to the RentWallet. Once it is in the RentWallet, it is destined to be dispersed to token holders.

This mechanism takes into account the potential volatility of owning real estate. Sometimes, tenants do not pay on time. Sometimes, they pay early. Sometimes they pay half now, and the rest later. The amount that is collected, and the time that is collected at are all inconsequential; it gets submitted to the RentWallet all the same.

Transparency

At RealT, we are transparency maximalists. We want to do whatever is feasible to turn the inner-workings of the RealT system inside out.

Unequivocally, the best way to do this is to leverage Ethereum as our back-end accounting platform as much as possible. Any and all data we can relegate to Ethereum, we will! Rental payments are one of the biggest low-hanging fruits we have in-front of us.

With this system, property owners can verify the deposits of rental payments into the RentWallets directly on the Ethereum blockchain. As the owner of Marlowe, when you see 775 USDC deposited into the Marlowe wallet (0xe5f7…..ef77c8), you have strong assurances that the money is coming to you over the next 30+ days.

Right now, RealT sends out rental income every 3 days, but there is nothing verifiable on-chain that RealT is actually going to send you your rental income within the next 3 days. With this new system, you have 30 days worth of transparency that the rental money collected is going to your Ethereum wallet.

Additionally, current and future RealT customers can begin to see a history of rental payments made to the property wallets. The long-term goal for this is that individual properties would have a growing history of timely (or not!) rental payments coming from the tenants. Very much like a credit score, but for the property itself!

Buffer

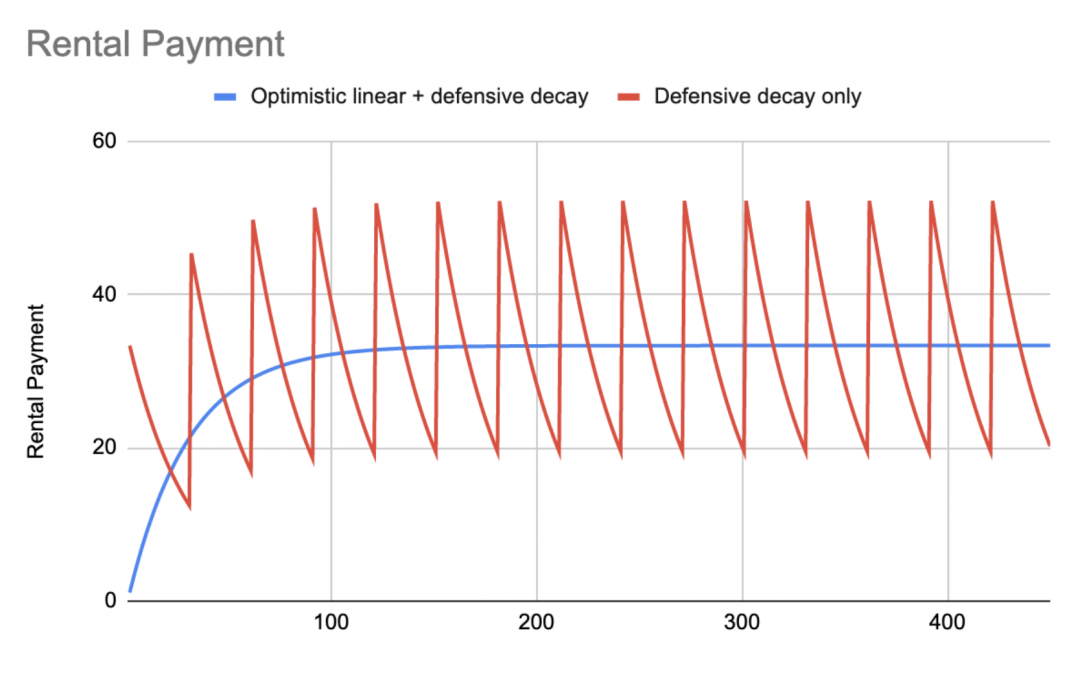

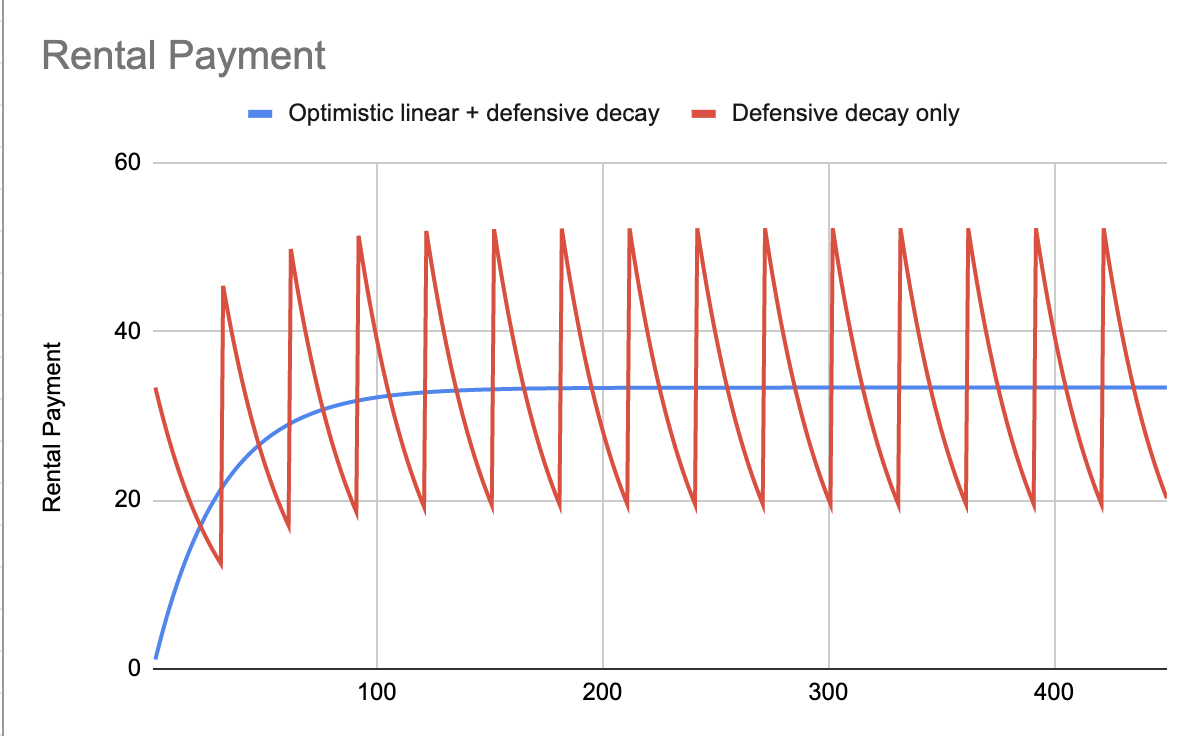

The ‘1/30’ calculation builds a rent-buffer over time. This is because with this method rental payments reduce over time. On Day 1, a 1,000 USDC Rent deposit distributes 33.33 USDC. On Day 2, there is 966.66 USDC in the rent wallet, and 1/30th of this is 32.22. On Day 3, it’s 31.15…

On the 30th day, this mechanism won’t have distributed the whole $1,000. On Day 30, there is $387 leftover when a new payment of $1,000 comes in. On Day 31 there would be 1374.13 total USDC in the wallet; 374.13 left undistributed from the previous month. On Day 61, there would be 1447.07; Day 91: 1490.02; Day 121: 1557.46.

This would asymptote to 56.66% the amount of 1 months of rent. For a property with $1,000/mo in rent, it would ultimately converge upon $1566.66 in the rent wallet at the beginning of every month.

This has both benefits and drawbacks!

It is good because the 566.66 USDC buffer that remains in the wallet at the end of the month will be continually distributed to property owners if rent is ever disturbed. If the property goes without a tenant for a month, there is still 566.66 USDC that will be distributed over time. Rent doesn’t just drop to 0, it just continues to reduce until a new rent check is collected from a new tenant.

This is bad because current owners of the property will have forgone 56.66% of 1-months of rent to supply to this buffer. While the buffer is nice, it does come out of the pocket of the current token owners. It would also be less than fair if a current owner sold their token in 2–3 months to a new owner, and that new owner never contributed to the buffer.

RealT community member thedavidmeister made a google sheet that simulates what is being discussed, which you can view here. Thanks David for contributing to the conversation and helping the community understand the new system on a more detailed level! ?

As you can see, the amount of rent paid over time is stable, while there are intra-month payments that go between peaks and valleys. It takes about 4–5 months for the rental payments to reach their asymptote, but the bulk of the discrepancy occurs in months one and two. The 3rd rental payment (90 days) would fill the rent wallet up to 98.5% of its asymptotic amount.

1/N

The 1/30 calculation scheme wasn’t the only mechanism we evaluated. The other system was a 1/N calculation, where N equals the number of days left in the month. The final day of the month would produce an N value of 1, which means that 1/1 of the rent in the rental wallet would be completely distributed and we wouldn’t have to concern ourselves with a buffer of 56.6% of 1-months rent.

However, this presented its own significant drawbacks. Mainly, rent from properties is not always collected on the 1st. Rent that is collected on the 5th or 15th would experience 0 rental payments for the first part of the month until the rental income is distributed into the rent wallet. This is not ideal, as it interferes with one of the core goals of RealT: not having the timing of rental payments impact the secondary market valuations of the tokens.

The purpose of this blog post is to open a dialogue with the RealT community about their opinion about this rent system. We understand that the rental payments are a large part of the benefits of holding RealT properties, and a new rental payment mechanism that retains an undistributed 56% buffer impacts this! We are asking for community feedback on this subject! If you have opinions on this matter, good, bad, or neutral, please let us know!

You can reach out to us in our Discord Channel

…In our Telegram Group

…Or in our French Telegram Group

…Or on Twitter