Available for RealT’s International TokenHolders Only.

Vous pouvez retrouver la version français de cet article en cliquant ici.

Introduction

Once again, RealT is at the forefront of DEFI and excited to announce a new feature – access to the RMM platform. Through a special partnership with Commutatio Holdings Limited, a British Virgin Islands Holding Company established to operate RMM, RealToken holders can come together to create a whole new paradigm of decentralized borrowing and lending.

Based on the Aave protocol V2, Liquidity providers (Lenders) gain the ability to earn interest and generate passive income returns, while providing liquidity for Borrowers on the RMM platform.

Borrowers pledge their RealTokens as collateral and can contract for a loan. In the Beta version, users will only be able to borrow Dai, which is a stablecoin. At the end of this Beta period, borrowers will have access to crypto-currencies like WBTC, WETH and other stablecoins. If the borrower is unable to complete the loan repayment, the collateral RealTokens can simply be used to repay the loan.

How does it work, operationally ?

I – Lenders are called “liquidity providers”

Each time a deposit is made on the RMM, ArmmTokens* are issued. These specific tokens track the value of the deposited asset and are burned when the loan is settled. During the term of the deposit, the asset is loaned to the borrowers and the ArmmTokens generate interest continuously, every second. They can also be freely stored, transferred and sold.

*ArmmTokens : Aave RMM Tokens

A – How ArmmTokens work

With each deposit, RMM creates and sends to the liquidity provider an equivalent amount in ArmmTokens. To withdraw your liquidity, you will have to perform a transaction which is to return your ArmmTokens to the RMM platform. In exchange, the RMM returns your deposited liquidity including the generated interest. There is a 1:1 ratio between the assets deposited and the number of ArmmTokens. This ArmmToken represents your deposit and can be interpreted as the tokenization of your loan/liquidity. Therefore, there is one type of ArmmTokens per market/asset. As explained above, your deposit earns continuous interest and the sum of your ArmmTokens increases at the same rate as the amount of interest you earn.

The accumulation of interest and the increase of your ArmmTokens are directly credited to your portfolio. Every second, a fraction of ArmmTokens is added to your portfolio according to the interest rate of the deposited asset. You can literally see your balance grow in real time. Then, these ArmmTokens can be exchanged for the liquidity they represent.

It is possible to transfer ArmmTokens to any address. The address does not need to be whitelisted, i.e. it is not subject to successful KYC. As soon as a wallet is counting ArmmTokens, the user can send them to another address.

Please note: It is not possible to send the entire amount in one transaction since during the validation of the transaction you generate interest. Therefore, there will be a small balance in the sender’s wallet after the transaction is completed.

If you have deposited a RealToken 1389 Bird and you have transferred your Armm1389Bird then you lose your right to the RealToken and the associated rent. We recommend that you keep your ArmmTokens in the same wallet where you deposited your assets.

Caution : You must be aware that if you send your ArmmTokens to an address that does not belong to you or that you do not control, then you will not be able to recover your cash deposited on the RMM. If you have deposited xDai and you no longer own your Armmxdai then you will not be able to recover your deposited xDai.

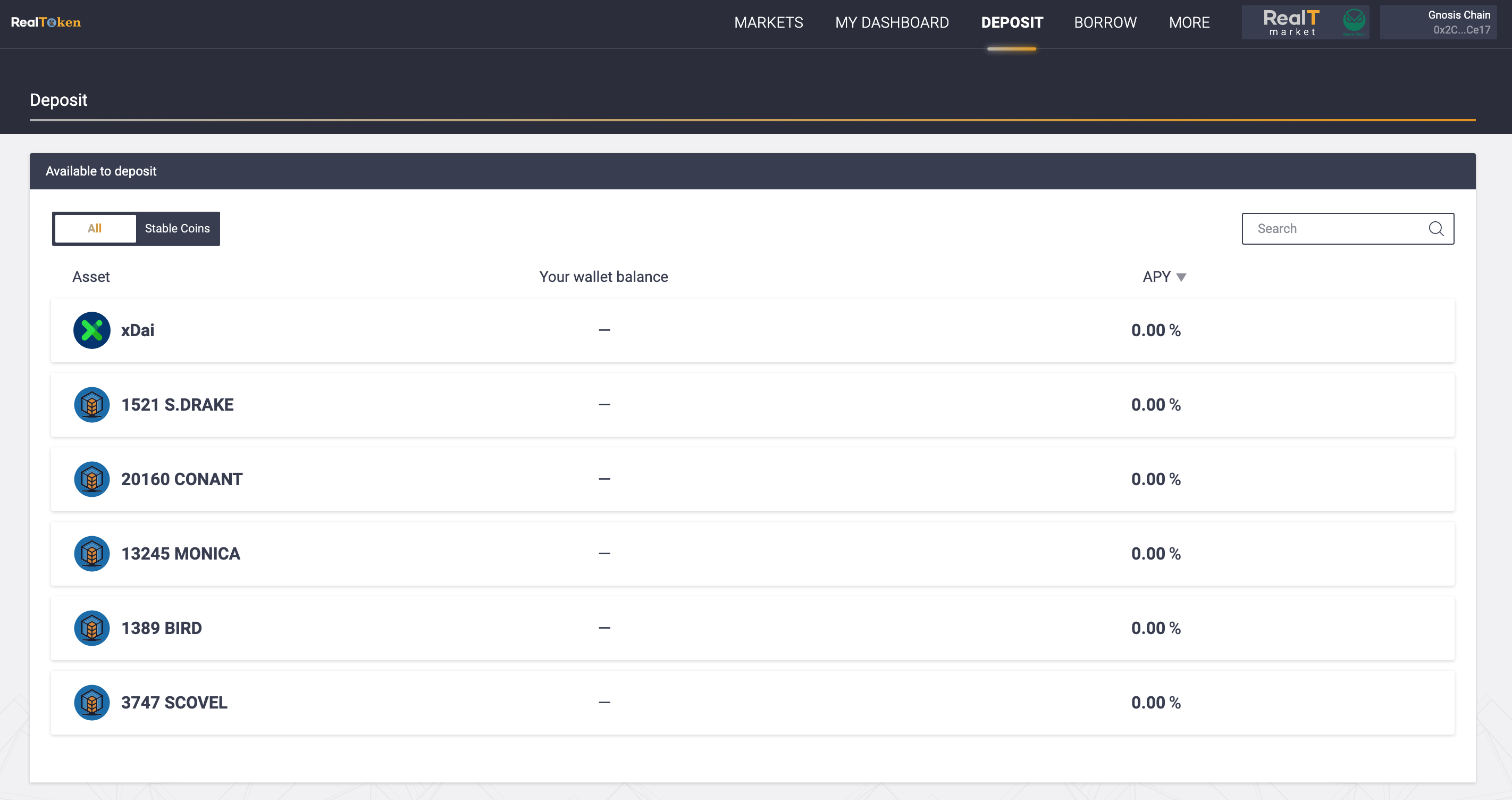

B- Depositing liquidity on the RMM

In the Beta version, only RealTokens and xDai deposits will be enabled. RealTokens can be collateralized by the depositors but it is not possible to borrow RealTokens. Therefore, no interest can be earned by the depositors. On the other hand, the deposited xDai can be borrowed. To use this liquidity provided by the lenders, the borrowers of these xDai have to pay an interest rate. This interest is redistributed to the liquidity providers allowing them to generate passive income.

Making a deposit is simple – just select the asset you wish to deposit from the list of assets in the RMM platform. Once selected, simply indicate the amount you wish to deposit. As soon as the deposit transaction is validated, the user begins to receive interest in ArmmTokens.

Each asset has its own market and liquidity so the rate for borrowing xDai or USDC, at the end of the Beta version, will be different. It is the supply and demand between borrowers and lenders that sets the interest rate. The interest rate fluctuates depending on events such as new deposits, liquidity withdrawals, new borrowings or credit repayments. The more liquidity deposited by lenders is used, the higher the borrowing rate.

Caution: When a market has low liquidity or high liquidity utilization, a liquidity provider may not be able to withdraw its entire deposit immediately (see detailed example below).

In summary, liquidity providers earn income on their deposited assets, which constantly fluctuate according to the market’s inconsistencies. Anyone providing liquidity in an asset shares in the interest paid by borrowers, which is the average borrowing rate * the utilization rate. The higher the utilization rate of liquidity in a market, the higher the return to the liquidity providers.

C- Example of a deposit

1- Deposit of stablecoin by investors on the RMM

Some investors want to get a return on their Stablecoins.

Mathieu deposits 50 xDai, Camille deposits 30 xDai and Peter deposits 20 xDai.

So there are 100 tokens available to borrow on the xDai market.

2- Deposit and collateralization of RealToken by RealT investors on the RMM

Eve has deposited 3 RealTokens of the 1389 Bird Ave property with a unit value of $50.29, so she can deposit and collateralize 3 RealTokens for $150.87.

The collateralization rate for this property is set at 50%.

Eve, to borrow 1 xDai, must pledge the equivalent of 2 xDai in RealTokens 1389 Bird Ave.

Eve wishes to borrow 70 xDai, so she must put up as collateral at least the equivalent of 140 xDai which is 2.78 1389 Bird Ave. This leaves 0.22 1389 Bird Ave collateralized and available.

Eve has just finalized her loan in xDai, now there are only 30 xDai left on the market.

3- A lender wishes to withdraw their funds

Matthieu, who had deposited 50 xDai, would like to withdraw all of his funds.

He will not be able to withdraw these 50 xDai directly, because only 30 xDai are available.

So he can currently withdraw 30 xDai and he will have to wait for new depositors to bring in xDai to withdraw his remaining 20 xDai.

As explained above, the interest rate is calculated as the ratio of available liquidity to borrowed funds. If this ratio decreases, then the interest rate for a deposit increases.

Paul sees that the deposit rate is more attractive on the RMM than on another collateralization platform and decides to move his liquidity to the RMM. He decides to deposit his 100 xDai. Mathieu can then withdraw his remaining 20 xDai. Meanwhile, he will have generated an interest on his 20 xDai deposits.

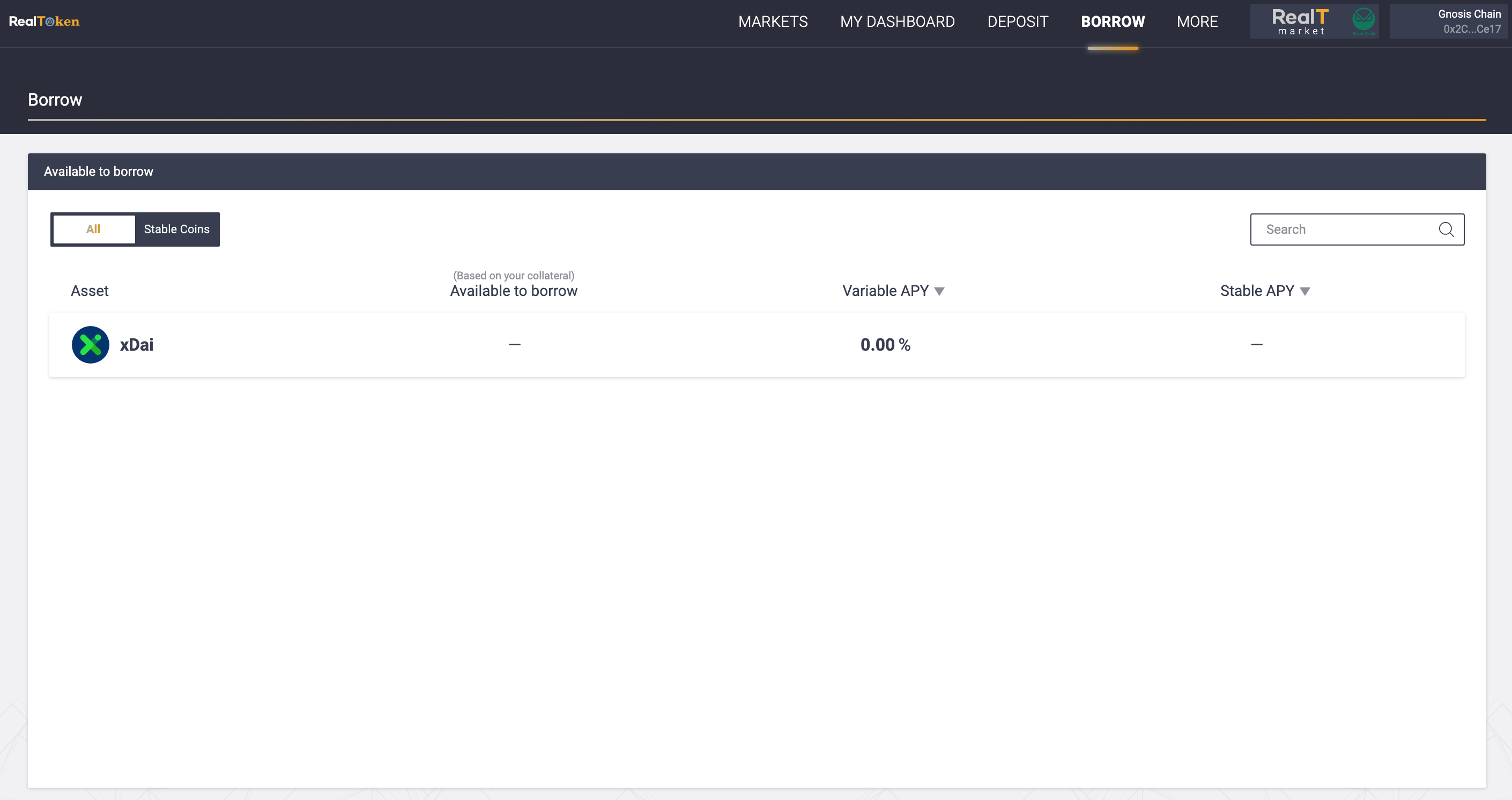

II- For borrowers

As mentioned in the introduction, a user must deposit and collateralize an asset to borrow. In the Beta version, only a few RealTokens will be available. At the end of this period, it will also be possible to have other assets like wBTC, wETH and many other RealTokens.

One can legitimately ask the question, what is the point of borrowing on RMM?

First, you can get liquidity at any time without needing to sell your RealTokens or another crypto-currency. This option can allow you to deal with an unexpected event like your car breaking down or take advantage of this new source of liquidity to capitalize on an investment opportunity. If your income from your RealTokens is higher than the interest rate, then you can pay off your debt gradually.

Second, you can use the leverage of collateralization to increase the return on your capital. We encourage you to read our detailed article on this subject by clicking here.

A- How do I take out a loan?

First of all, it is necessary to deposit RealTokens or other assets that will serve as collateral; this is called “collateralization”. Then in the Borrow section you can select the asset you need.

The amount you can borrow will depend on the amount you have deposited as collateral.

The repayment of your loan is done in the same asset. For example, if you borrow 1000 xDai , you will have to pay back 1000 xDai plus the accumulated interest. You can also use your asset as collateral to repay your loan.

As with lenders, the interest rate you pay on your loan varies according to supply and demand. You can find the interest rate on your loan at any time in the Loan section of the dashboard.

B- Choosing the interest rate for your loan

The stable rate

The stable rate works like a short-term fixed rate. However, it must be noted that if market conditions change, this rate can be readjusted. While the rate may remain relatively stable, 2 conditions can occur that could cause a modification:

- If the utilization rate is above 95%.

- If the average loan rate is below 25%.

Please note that the stable rate is deactivated in the event you want to borrow more than 25% of the available liquidity. To choose the stable rate, you will need to select a smaller amount to borrow so as not to exceed 25%.

The variable rate

This rate is based on supply and demand within the RMM. The variable rate fluctuates according to the market. It can therefore be more or less advantageous depending on the situation compared to the stable rate.

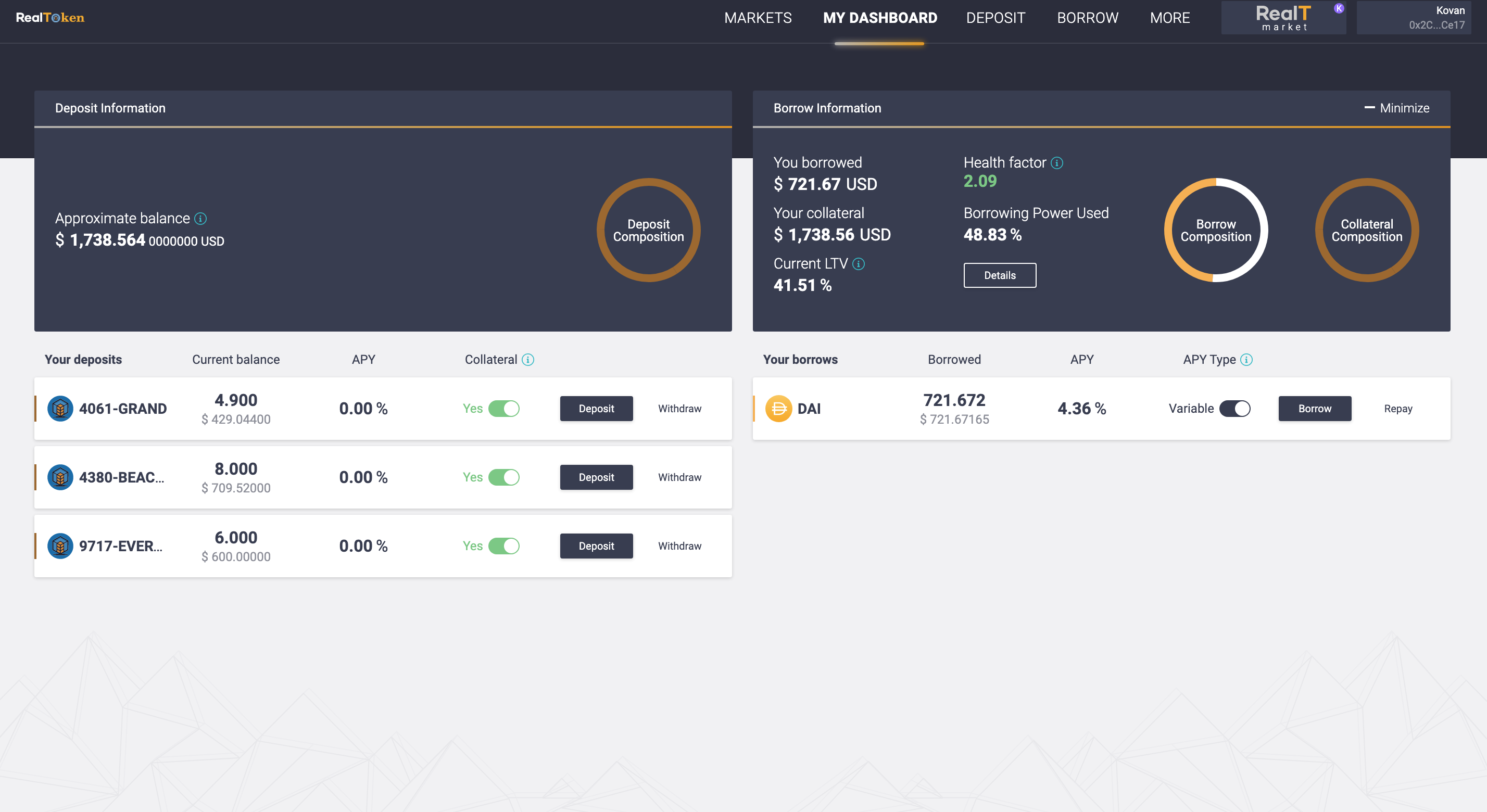

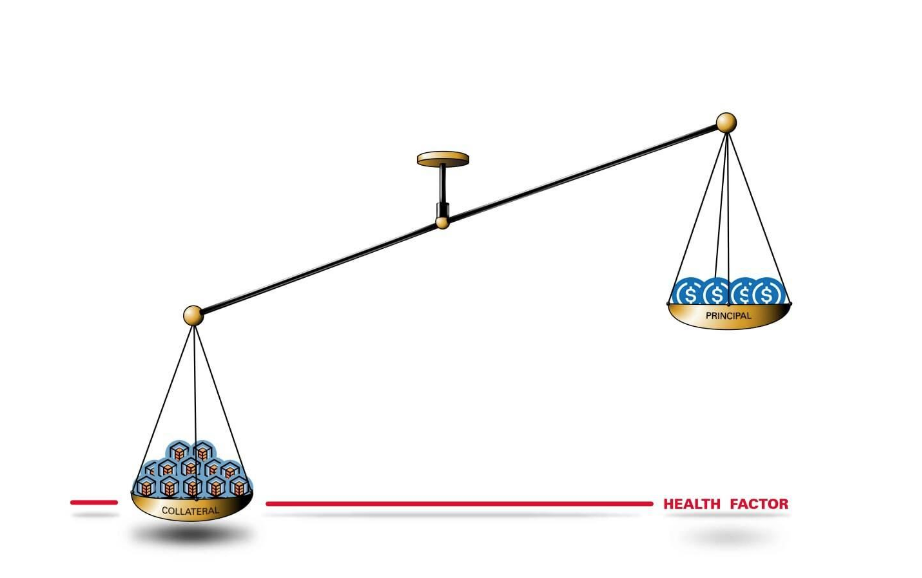

C- Managing the Health Factor and avoiding liquidation

The Health Factor is a number that tells you the ratio between the assets deposited as collateral and the value of the underlying asset borrowed. The Health Factor is the inverse of the Loan To Value, which we have explained in this article.

Thus, the higher your Health Factor, the lower your liquidation risk. If your Health Factor goes down to 1, it means that the value of your collateral is equal to the value of your loan. The liquidation of part of your deposit can be triggered. Keep in mind that a Health Factor of 1 or less has a high chance of being liquidated. A Health Factor of 2 means that the value of your collateral can decrease by 50% before triggering a liquidation risk.

Variation of the Health Factor

Depending on the fluctuation in the value of your deposits and loans, the health factor increases or decreases. If it increases, it means that your financial position is improving and that you are moving away from a liquidation risk.

On the contrary, if the value of your collateral decreases in relation to your loan, your Health Factor decreases, which brings you closer to a liquidation risk.

Period of repayment of your loan and its interest

There is no specific date or schedule for repaying your loan. As long as your position is above the liquidation threshold (Health factor > 1), you can borrow indefinitely. However, when you borrow, you must pay interest. Over time, this interest to be paid back will accumulate in your loan balance. The amount of your loan will increase and therefore lower your Health Factor.

To increase your Health Factor, you have two options:

- Repay a fraction of your loan

- Deposit new assets as collateral

Liquidations

Liquidation is a mechanism that is triggered when the value of your collateral is lower than the value of your loan. In this situation your Health Factor is less than 1. During a liquidation, a maximum of 50% of the value of the loan can be repaid. To repay your debt, part of your collateral is sold plus a liquidation penalty* which is deducted from your collateral.

*The liquidation penalty depends on the asset used as collateral.

After liquidation, the value of your collateral has decreased in greater proportion to your new loan balance.

Example:

Matthew deposits 5 RealTokens 1389 Bird Ave for $251.45 and borrows 125.72 xDai.

His Health Factor falls below 1 and part of his position is liquidated.

A liquidator can pay back up to 50% of a single line of borrowing or 62.86 xDAI.

In return, the liquidator can recover the collateral 1389 Bird Ave (+10% liquidation penalty bonus).

The liquidator’s bonus varies from asset to asset.

The liquidator can get back up to 2.75 RealToken 1389 Bird Ave (2.5 RealToken + 2.5*10%) for paying off 62.86 xDai.

The liquidator has therefore gained 0.25 RealToken 1389 Bird Ave in the operation.

How do I avoid liquidation?

To avoid the risk of liquidation, you should keep your Health Factor above 1.

Note: For the same amount of money, partial repayment of your loan allows you to increase your Health Factor by a greater proportion than adding collateral.

Maintaining a Health Factor above 2 gives you a safety margin to manage your position before a potential liquidation risk. You need to stay alert to market fluctuations for volatile assets like wBTC or wETH as well as monitoring your RealTokens. Stablecoins are not exactly equal to $1 at all times. All these parameters can affect your health factor up or down.

D- Example of a loan

Karolina has a diversified portfolio of RealToken and deposits as collateral :

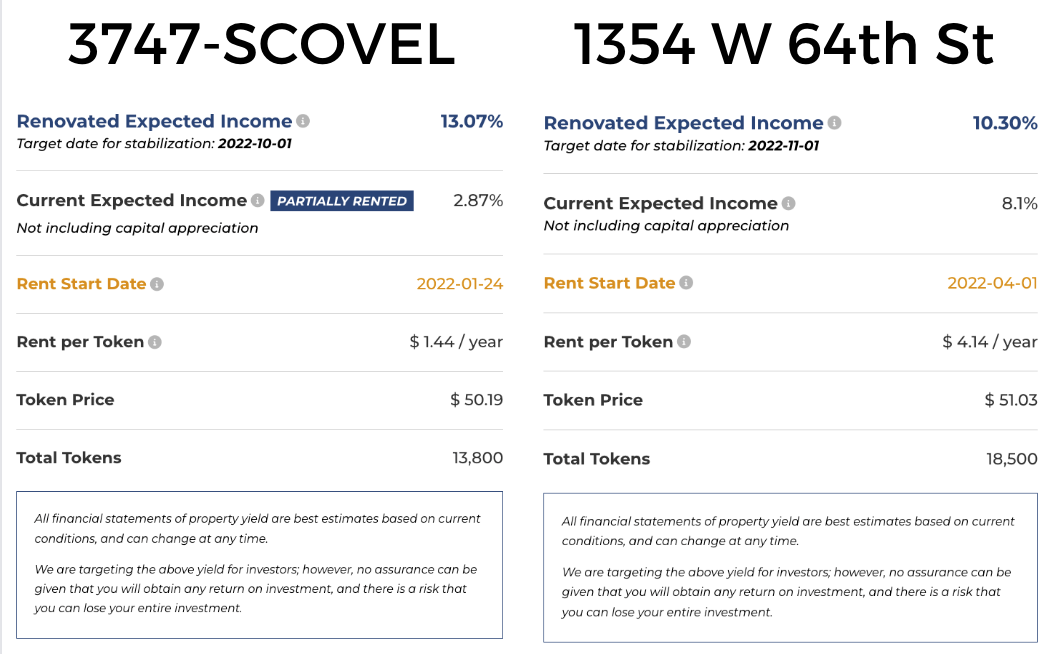

- 50 RealTokens 1389-BIRD equivalent of $2,514.50 (50* $50.29)

- 50 RealTokens 1354 W 64th St equivalent of$ 2,551.50 (50*$51.03)

- 50 RealTokens 3747-SCOVEL equivalent of $ 2509.5 (50*$50.19)

- 50 RealTokens 20160 Conant equivalent of $ 2,594.50 (50*$51.89)

These 200 Realtokens represent a value of $10,570.00 with an expected RONA of 7.28%. (50*$3.78 + 50*$4.14 + 50*$1.44 + 50*$6.04) / $10,570.00).

If you want to understand this concept of RONA click here.

Karolina could borrow up to $5,285.00 (collateralization rate set at 50% * $10,570.00).

In order to avoid the risk of liquidation, Karolina is cautious and prefers to keep a safety margin and borrows 4,000 xDai with an interest rate of 4%.

She decides with this 4,000 xDai to acquire new RealTokens 1354 W 64th, and to deposit them as collateral and borrow another 2,000 xDai. Thus, she makes a loop.

With a capital of $10,570.00 and thanks to the leverage effect of the collateralization, Karolina’s return increased from 7.28% to 10.20% (($1,378.46 – $300) / $10,570.00).

The financial profitability of the operation increased by 2.92% (10.20% – 7.28%).

We have not taken into account the last source of income explained in this article which can potentially increase the financial profitability of the operation.

At the end of the renovation, the expected RONA of 3747-SCOVEL should increase from 2.87% to 13.07% and the expected RONA of 1354 W 64th St should increase from 8.10% to 10.30%.

In our analysis, we do not take into account the potential revaluation of the property at the end of the renovation.

At the end of the work, the expected RONA before using the leverage of the collateralization would be 10.18% ((50*3.78+50*5.25+50*6.46 +50*6.04) / $10,570.00).

With the leverage of collateralization we would have the following table:

With a capital of $10,570.00 and thanks to the leverage effect of the collateralization, Karolina’s return increased from 10.18% to 14.66% (($1,849.58 – $300) / $10,570.00).

The financial profitability of the operation increased by 4.48% (14.66% – 10.18%).

Today, Karolina’s expected RONA is 7.28%.

At the end of the renovation and using the leverage of the collateralization, the expected RONA of Karolina will double from 7.28% to 14.66%.

Again, in our analysis we do not take into account the potential gains on a property upon revaluation which is explained in this article. We do not take into account the reinvestment of the rent in RealToken deposited in turn in the RMM which will be the subject of a new article.

———————————————————————————————————————–

This information is provided as a tool to explain the functionality available on Commutatio Holding Limited’s RMM platform for RealToken users. This information is not an offer to invest in any token, Fund or other opportunity and is provided for information only.

Performance results are shown as estimates and net of all fees, costs, and expenses associated with the token. Should an investor choose to redeem a token through RealT or on a secondary market, other fees and expenses may be assessed that are not factored into the returns presented.

Past performance does not guarantee future results. Individual investor returns may vary based on the timing of their investments and redemptions.