Understanding the financial mechanisms related to collateralization

Vous pouvez retrouver la version français de cet article en cliquant ici.

RealT takes a very conservative approach to reporting effective income (yields) on its properties. The purpose of the article is two-fold – 1) to educate our Tokenholders on how we uniquely calculate our yields, and 2) to offer potential options to our Tokenholder’s to increase their returns.

In this article, we will be discussing 3 potential sources of income for a real estate investor:

- The expected income also called the Return on Net Asset (RONA)

- The capitalization generated by the leverage effect (Credit leverage)

- The potential gains on a property upon revaluation.

I – Return On Net Asset (RONA)

It is important to note that as an investor in RealT, only the first source of income is stated. On its website, RealT states an Expected Income % equal to the estimated Return on Net Asset (RONA).

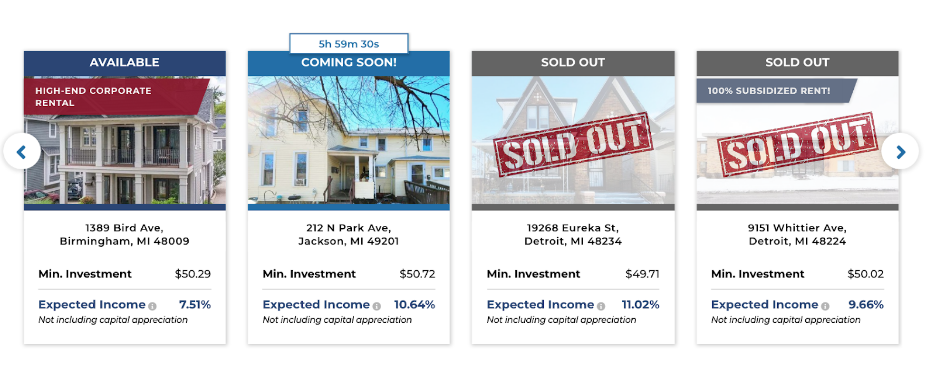

The calculation of the RONA is very simple: Expected net income divided by the total investment of the property. Two examples from the RealT home page are below: expected RONA for 1389 Bird Ave is 7.51% and 10.64% for 202 N Park Ave.

How is the 7.51% income calculated for the Bird property?

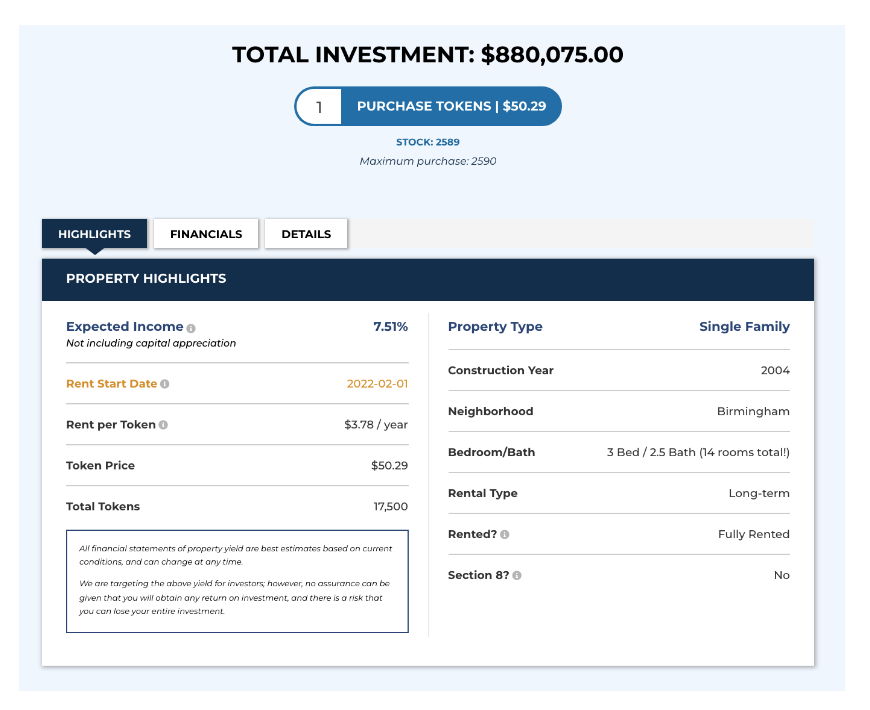

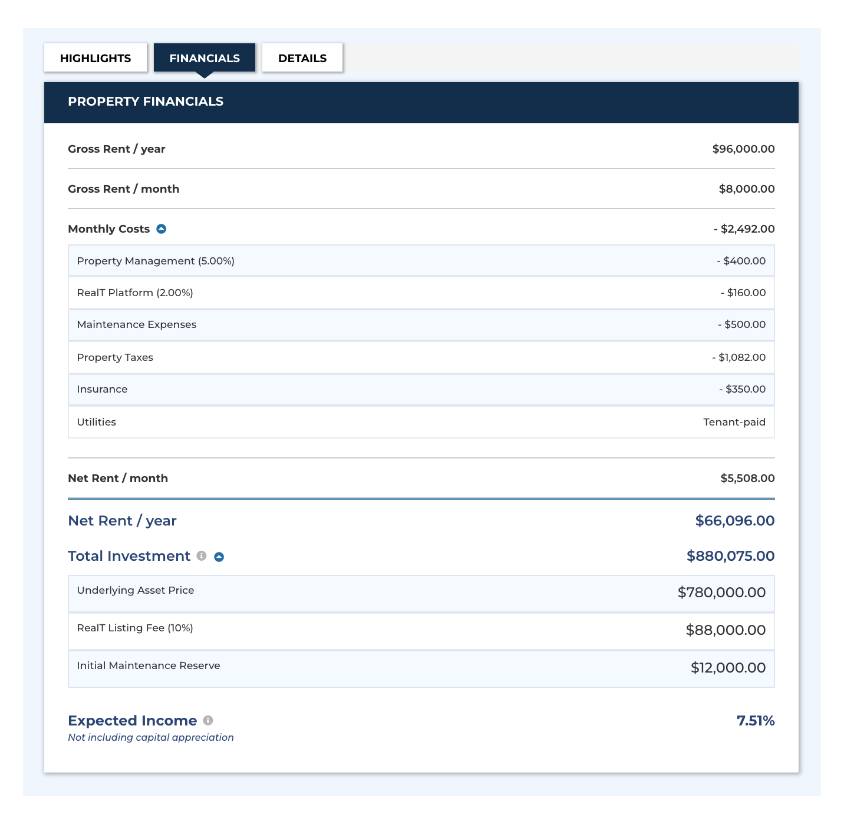

1 – From the property financials posted on RealT’s website, you can see that this property is being offered for sale at a total purchase price of $ 880,075.*; also called the Total Investment.

This purchase price is broken down as follows :

- Underlying Asset Price : $780,000

- Operating Expense Reimbursement (10%) : $88,000

- Initial Maintenance Reserve : $12,000

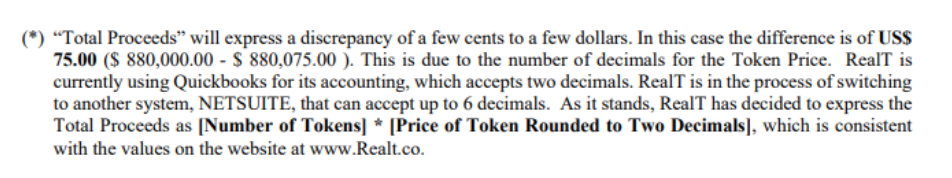

*The final selling price is adjusted by $75 because of the number of decimal points related to the price of the RealTokens during tokenization. Below you have an excerpt from the legal document with the explanation.

2 – The gross annual rent is $96,000 and the annual costs are $29,904 ($2,492 .12). The estimated net rent for the year is $ 66,096.

3 – The Return On Net Asset is 7.51% ($66,096 / $880,075 = 7.51%) or $3.78 per RealToken ($66,096 / 17,500) . 17,500 equals the total # of tokens issued.

II- Credit Leverage

RealT has made a strategic choice to not capitalize on the leverage of credit. All RealT properties are 100% funded through the sale of equity, (RealTokens). No credit is issued which means that 100% of the property is purchased with investors’ funds. There are several reasons for this strategic choice :

- Some people, for personal, religious or economic reasons, do not wish to depend on credit. In case of a financial crisis, as it was the case in 2008, real estate assets cannot be seized in case of difficulty in repaying the loan.

- What happens if the property is not rented for several months?

If RealT had chosen to take a loan out for the property, instead of fully funding it with equity sales, a loan payment would need to be added to the recurring expenses of a house. In the event a property has vacancies resulting in less rental income than projected, a property will experience a shortfall of cash flow. However, the loan payment and the recurring normal property expenses continue and must be paid. After a few months, the company’s cash flow will not be able to cover its expenses.

It will have 3 choices:

- Sell the property

- Current investors will have to contribute additional funds to make up the shortfall.

- New investors could be added to provide additional funds, but this will result in diluting the share of the previous investors.

For these main reasons, RealT wants the option of the utilization of credit leverage to be an individual Tokenholder’s choice.

To do so, RealT has developed a new module: The RMM powered by AAVE. All the technical aspects will be discussed in this article. To summarize, this module allows you to create your own credit leverage by collateralizing your RealToken in order to borrow. Since this is an individual choice, the risk of liquidation only occurs by the user who chooses to activate this feature.

And this is not a feature that is unilaterally occuring for all Token Holders on the same property. RMM allows for some token holders to choose to collateralize their RealTokens while allowing others to not.

For example, with 1389 Bird Ave, Birmingham, MI 48009:

You choose to deposit 200 of your Bird Ave RealTokens with a value of $10,058 (200 * $50.29 Token Price) with an expected RONA of 7.51%. At a 60% Loan To Value (LTV) rate*, you could borrow up to $6,034.8 (60% * $10,058).

*Loan To Value (LTV) rate is calculated by dividing the amount borrowed by the investment and/or appraised value of the property, expressed as a percentage. The higher this ratio, the more debt you have and the more you increase your liquidation risk.

However, in order to avoid the risk of liquidation, you decide to keep a safety margin, and instead only borrow $5,000 (LTV 49.7% i.e. $5,000$ / $10,058) at an interest rate of 4%* .

*The calculation of the interest rate is explained in the technical article.

You decide that with your new borrowed funds of $5,000, you are going to buy additional RealTokens and deposit them as collateral. By borrowing again, this time you choose to borrow 50% of your last deposit and receive another $2,500 ($5,000 * 50%). Your current LTV is 49.8% (($5,000 + $2,500) / ($10,058 + $5,000)), You decide to make a loop.

| Loop | Portfolio | RONA 7.51% | Interest 4% |

| 0 | $10,058.00 | $755.36 | |

| 1 | $5,000.00 | $375.50 | $200.00 |

| 2 | $2,500.00 | $187.75 | $100.00 |

| 3 | $1,250.00 | $93.88 | $50.00 |

| 4 | $625.00 | $46.94 | $25.00 |

| Total | $19,433.00 | $1,459.42 | $375.00 |

With initial capital deposited totalling $10,058 and thanks to your collateral leverage, your return of 7.51% has increased to 10.78% ((Total income of $1,459.42 – Interest expenses of $375) / $10,058 of initial investment).

The financial profitability of the transaction has increased by 3.27% (10.78% – 7.51%).

If you want to optimize the leverage of the invested capital you have 3 ways to do this:

- Increase the RONA

- Reduce the cost of debt, i.e. the interest rate

- Increase the debt if the RONA is higher than the interest rate

A – Increase the RONA

To increase the RONA, you can either increase income or decrease costs. Today, inflation in the US is close to 7% and RealT has indicated that in the next 18 months, rent is expected to increase significantly on some properties.

On the other hand, through RealT’s strategy of concentrating properties in a particular city, such as Detroit, RealT is beginning to realize economies of scale. These economies allow it to lower the cost of managing the properties. One can see the first effects on this optimization by reviewing 2 properties in RealT’s offerings – Cadieux Street or Greenfield Street.

For example, with regards to the rental income, if we make the assumption that RealT is able to secure rental increases of 5.2%, then the annual gross rent increases from $96,000 initially to $100,992. The net rent increases to $71,088.

The expected RONA for Bird has now increased from 7.51% to 8% ($71,088 / $880,075, the total investment).

B – Reducing the interest rate

On the RMM the loan rate is reduced from 4% to 3%*.

*The calculation of the interest rate will be explained in the technical article.

C – Increase the debt if the RONA is higher than the interest rates

At the same time, for the Bird property, the DAO, once in place, decides that it is possible to borrow up to 70% of the RealToken value because the property is located in one of the best neighborhoods in the United States. Historically, the neighborhood has increased in value every year.

So the investors decided to borrow 60% to avoid the risk of liquidation.

Let’s go back to our example :

| Loop | Portfolio | RONA 8% | Interest 3% |

| 0 | $10,058 | $804.64 | |

| 1 | $6,034.80 | $482.78 | $181.04 |

| 2 | $3,620.88 | $289.67 | $108.63 |

| 3 | $2,172.53 | $173.80 | $65.18 |

| 4 | $1,303.52 | $104.28 | $39.11 |

| Total | $23,189.72 | $1,855.19 | $393.95 |

With a capital of $10,058 and thanks to the leverage effect of the collateralization, the return of 8% has increased to 14.53% (($1,855.19 – $393) / $10,058).

The financial profitability of the transaction has increased by 6.53% (14.53% – 8%).

III- Potential Gain On a Re-Valued Property

The expected income presented on RealT’s website does NOT take into consideration the potential appreciation or depreciation that occurs annually through re-evaluations on the properties. Generally, on an annual basis, RealT engages an appraisal firm to perform an independent third party evaluation of a property. The data of the RealT properties’ first evaluation have shown an overall average increase ranging between 12 – 15% year over year. The RealTokens have gained between 2% and 5% as the 10% RealT commission for Operating Expense Reimbursement is deducted from the RealToken price and converted into a governance token.

Jean-Marc Jacobson and Rémy Jacobson have made it clear that although this past year resulted in increases, this is not an indication of the future. In fact, they believe that the next appraisal cycle will result in lower percentages. .

Currently there is a huge property demand in the real estate markets where RealT is positioned. This increased property demand has resulted in sourcing difficulties with properties that have interesting expected RONA’s. As a reminder, the RONA is the expected net income divided by the total investment of the property. If the price of a property increases faster than RealT’s ability to achieve increasing rents on a property, then the RONA decreases.

In our next example for analysis, we will take into consideration an annual increase of 2% on the value of the property after excluding the 10% Operating Expense Reimbursement .

If we continue with our example above, we deposited 200 RealTokens of property 1389 Bird Ave, Birmingham, MI 48009 for a value of $10,058 with an expected RONA of 7.51%.

We had at the end of our loop a capital of 386.42 Bird RealTokens which is equivalent to $19,433.00. At the end of the year Bird is revalued upwards by 2%.

The RealToken which was initially listed at $50.29 has increased to $51.29. (($51.29-$50.29)/50.29)

Our investment goes from $19,433 to $19,821, which is an additional gain of $388.66.

In our second example, we deposited 200 RealTokens of the property 1389 Bird Ave, Birmingham, MI 48009 for a value of $10,058 with an RONA of 8%.

We had at the end of our loop a capital of 461.12 RealTokens Bird which is equivalent to $23,189.72.

At the end of the year Bird is revalued by 2%.

The RealToken goes from $50.29 to $51.29.

Our investment goes from $23,189.72 to $23,653.51 which makes an additional gain of $463.79.

IV – Conclusion

In this article, we highlighted 3 different ways to make money with real estate. RealT has always had a policy of announcing the expected RONA on its website while other competitors prefer to incorporate the 3 leverages directly.

RealT prefers to announce 7.51% while other competitors would have announced 14.42% on their website.

- RONA: 7.51%.

- Leverage: 3.27%

- Potential capital gain: 3.64%

Other competitors would have gone further by taking into consideration the potential value of the rent. They would have announced 19.14%:

- RONA: 8%.

- Leverage : 6.53%

- Potential capital gain: 4.61%

RealT will continue to advertise only the expected RONA on its website.

However, as Rémy and Jean-Marc have announced, it is increasingly difficult to find properties with an expected RONA of 10% / 11% without major renovation costs. It is important to note that the numbers have been a representation of the current market conditions, and that property declines may occur instead.

When RealT launches on the European market, it is very likely that the expected RONA will be around 8%.

For investors wishing to maintain and increase the return on their investment, it will then be appropriate to start using the collateralization.

Some of our investors have told us that it is preferable to use the reinvestment property rather than the RMM.

These two tools are compatible and we will explain the possible synergy between these mechanisms in a future article.

———————————————————————————————————————–

This information is provided as a tool to explain the functionality available on Commutatio Holding Limited’s RMM platform for RealToken users. This information is not an offer to invest in any token, Fund or other opportunity and is provided for information only.

Performance results are shown as estimates and net of all fees, costs, and expenses associated with the token. Should an investor choose to redeem a token through RealT or on a secondary market, other fees and expenses may be assessed that are not factored into the returns presented.

Past performance does not guarantee future results. Individual investor returns may vary based on the timing of their investments and redemptions.