RealT In Review

Vous pouvez retrouver le version française de cet article en cliquant ici.

RealT was launched in 2019 with the promise of making real estate accessible for only $50. Three years later, our over $52 million in tokenized real estate assets show that anyone can build a real estate portfolio. Today, RealT has tokenized more than 970 units, which represents about 1 unit per day since inception, and these units are located across the United States in places like Detroit, Cleveland, Chicago, Toledo, and Florida. RealT also allows for property type diversification with single-family, duplex, and multi-family dwellings.

With today’s economic and geopolitical uncertainties (inflation, currency volatility, crypto-crash, and stocks down since the beginning of 2022), we thought it would be interesting to analyze how RealT’s real estate portfolio has performed. Some people are trying to find adequate investment for their profiles. And today thanks to blockchain technology, RealT is the leading security token backed by real estate assets that pays tokenholders distributions every Monday.

Real estate has often been considered a haven for two main reasons:

- In Maslow’s Hierarchy of Needs, housing is a primary need; tenants cut back on leisure and non-essential expenses to keep their homes.

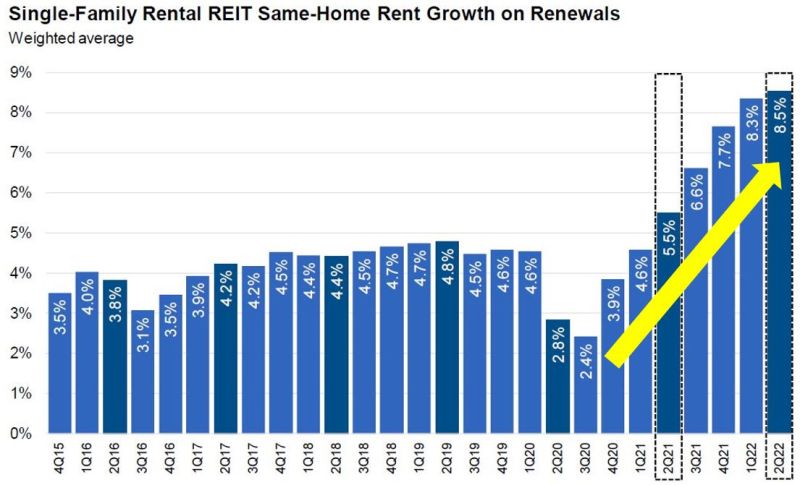

- Legally it has always been possible to index rents to the inflation rate. However, as explained in the last community calls, despite their 20 years of real estate experience, the Jacobson brothers have rarely experienced such an inflationary period. Leases are likely to be indexed to inflation. However, part of this increase will be passed on to current tenants. Indeed, RealT prefers to keep its tenants as long as possible in order to maximize the return. The graph below reflects this trend well.

Institutional investors also seem to be gradually shifting their strategies away from retail and office to focus on multifamily, industrial and data centers in the last few months.

As a reminder, at its beginning RealT specialized in a sub-niche in the multi-family market with section 8 properties. This sub-niche allowed RealT not to have any unpaid rents during the COVID crisis.

RealT, as the pioneer in real estate tokenization, now has a significant track record in real estate management. Over the last 3 years, the vacancy rate has been very low, and the turnover between tenants has lasted, on average, 30 to 45 days, enough time to select a new tenant and refresh the unit.

The portfolio has not experienced any significant events involving non-payment of rent, deterioration of units by tenants, or squatting in vacant units. The only unforeseen events were a fire in late August/early September 2020 in the Fullerton building, with no personal injury to tenants.. For several months, investors did not receive distribution on the property, and the RealToken price was reduced. However, when the property was revalued, the Tokens Holders got an interesting update with a revaluation of +28.28%, which means an increase of the RealToken price of 14.8% compared to the initial price. Recently, as explained in this community call, an SUV crashed into the Greenfield building. All these minor events are external factors, and RealT has not experienced any major management problems thanks to a perfect knowledge of this high yield market, which is the B – / C class.

We have seen that RealT only announced the expected return and did not consider the effect of credit/collateralization leverage or a potential capital gain. In the next part of our article, it would be interesting to know if your real estate portfolio has increased in value, and what impact the exchange rate may have had on your RealT real estate portfolio. To do this analysis, we did the same exercise again, assuming that we had purchased one RealToken of each property.

Exchange rate

We decided to end with the data for our analysis for the first half of 2022*.

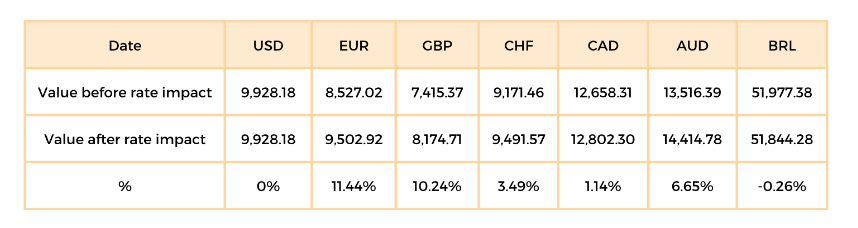

If an investor had invested in one RealToken of each property, he would own a fraction of 188 properties with a value of $9,928.18 and an average yield of 10.51% before vacancies, distribution, revaluation, and property revaluation. Since April 14, 2022, it is also possible to leverage collateralization through the RMM to improve your yield.

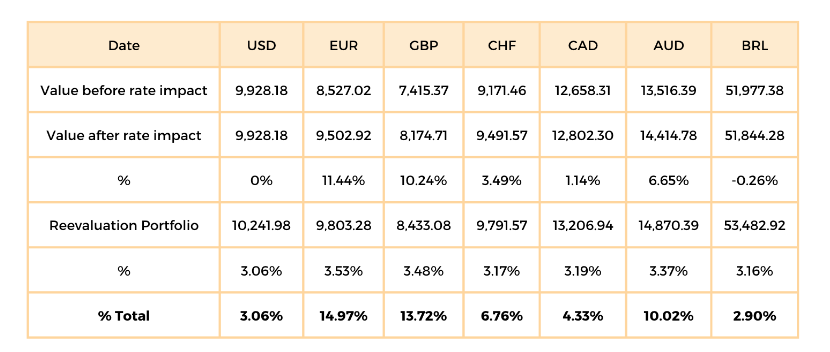

To acquire these 188 RealTokens, an investor would have invested between 8,527.02 € and 51,977.38 BRL, depending on his country’s currency. Today with RealT you invest in real estate in the United States, and you receive your distribution in USDC or reinvestment property tokens every Monday. For several months, the dollar has been appreciating against some currencies and depreciating against others. It would be interesting to analyze the value of the portfolio of an investor who has invested in a RealToken of each property at the exchange rate as of 06/30/2022.

Here is the result:

We can see that a European would have seen his wealth appreciate because the euro fell against the dollar, while a Brazilian would have experienced a loss of 0.26%.

Potential Gain On a Re-Valued Property

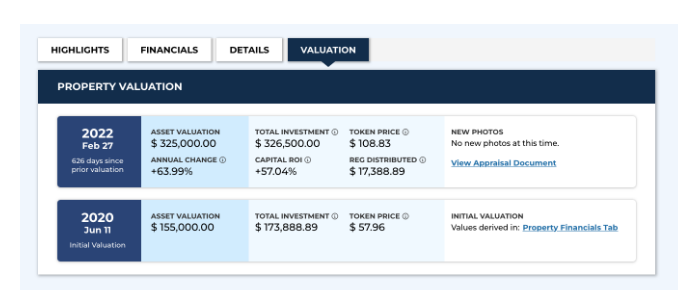

Based on community feedback, we have recently added a new feature to the site’s homepage and property pages. It is now easier to track the performance of your portfolio via property revaluations!

Each investor uses different KPIs or mathematical formulas to evaluate the performance of his portfolio. RealT has chosen to display two indicators while taking into account the notion of period in the calculation of the performance: the Annual Change and the Capital ROI.

The Annual Change is intended to highlight the intrinsic performance of the property, while the Capital ROI is aimed at presenting the performance of the capital invested by the Token Holder. For example, for 272 N.E. 42nd Court, Deerfield Beach, 3,000 RealTokens were offered for sale for $173,888.89 with the following details:

- $155,000 (Underlying Asset Price)

- $17,388.89 (10% Operating Expense Reimbursement Income)

- $1,500.00 (Maintenance Reserve)

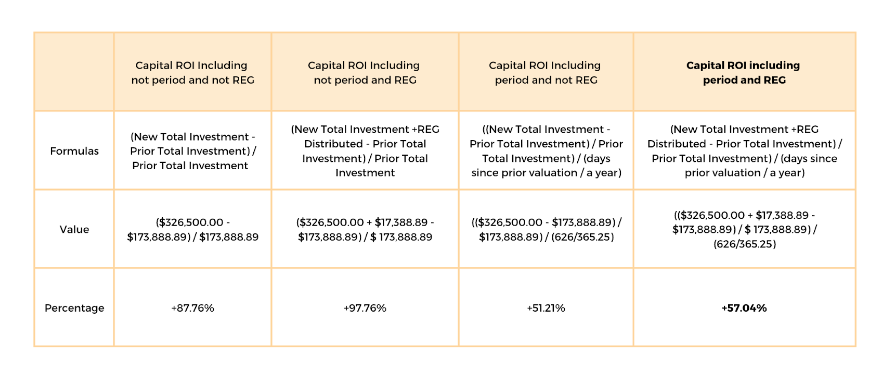

626 days after the date it was offered for sale, the property was revalued at $325,000.00. Some investors could have made ($325,000.00 – $155,000.00) / $155,000.00) and therefore enjoy a performance of 109.68%. RealT decided to take into account the time factor in the equation, since between the tokenization date and the revaluation date there were 626 days, so RealT shows +63.99% (109.68% / (626 / 365.25)).

Regarding the performance of the amount invested in RealT, some investors might consider the redistribution of REG and the time factor in their analysis. As a reminder, in the first year, the 10% Operating Expense Reimbursement is removed from the RealToken price to be redistributed in SOON tokens, which will be exchanged for the REG token once it is launched. By varying these 2 parameters it is possible to have a Capital ROI varying between +51.21% and +97.76%.

For the end of this article, we have chosen not to take into account the period of time and the distributed REGs in order to have a different approach than the one proposed directly on our website, allowing you to choose the method that suits you best. In this analysis we do not take into account time between revaluations because a Token Holder may have bought some RealTokens on the secondary market. We also exclude the distributed REG because on the secondary market, its value will vary according to supply and demand.

RealT has been a leader in the real estate tokenization market since 2019. As of 06/30/2022, 67 properties had already been revalued, including the first reinvestment house and the first property offered only to accredited investors (REG D). Excluding these two properties, these 65 properties show an average increase of 22.59% in property value, with exceptional appreciations such as 272 N.E. 42nd Court, Deerfield Beach (+109.68%), 4061 Grand St (+74.44%), 18433 Faust Ave (+36.36%), 14231 Strathmoor St (+34.00%) and 10024-10028 Appoline St (+33.77%). On average, RealToken prices have increased by 8.10%.

Considering the revaluation of his properties, the portfolio goes from $9,928.18 to $10,241.98, an increase of 3.06%. So, in addition to the distributions collected every week, a Brazilian would have gained +2.90% on his real estate portfolio while a European person would have made +14.97% for example.

By investing regularly with RealT, you are making DCA on two aspects, which are real estate and dollars. By participating in our new sales, you are smoothing your entry point on the value of real estate and on the EUR/GBP/CHF/etc. vs USD.

Disclosure

This information is not an offer to invest in any token or other opportunity and is provided for information only. Any offer to sell or solicitation to buy interests in the Issuance will be made only by means of an offering memorandum delivered by an employee or agent of the Issuer. Any references to past performances are informational and cannot be considered to indicate or guarantee any future results. Investing in crypto currencies involves a substantial degree of risk. There can be no assurance that the investment objectives described herein will be achieved. Investment losses may occur, and investors could lose some or all of their investment. Performance results are shown net of all fees, costs, and expenses associated with the token. Should an investor choose to redeem a token through RealT or on a secondary market, other processing fees may be assessed that are not factored into the returns presented.